|

What Are the DIY Jobs That We Can’t (Or Won’t) Do?

In this month's newsletter, after a period of uncertainty vendors and buyers are returning to the property market and we reveal some of the DIY jobs that UK homeowners are unwilling or unable to do.

Also this month, we share some advice on how to buy a second home and we reveal the average difference between the asking and selling price.

Vendors and Buyers Return to the Market

Although activity on the property market was sluggish at the beginning of 2018, recent reports from the National Association of Estate Agents (NAEA) indicates a rise in activity in the last few months – from both vendors and buyers.

An increase in market movement is by no means a surprise during the warmer months.

Figures from the NAEA's latest housing report found that, on average, UK estate agents had 33 homes available for sale in April, a number that rose by 12% to 37 homes per branch in May.

Whilst this recent market activity only accounts for a third of the activity seen in 2008, that being of 97 homes per branch, nonetheless, these figures are still a welcome sign as demand has continued to greatly outpace supply over recent years.

As expected, demand is still on the rise as the recorded number of prospective buyers per branch saw a modest jump of 337 in April to 351 in May. In comparison, May 2016 recorded 304 buyers per branch, showing a steady increase.

The report also found that the number of sales agreed remained static, with both April and May recording eight sales per branch, a figure that is down by two in comparison to 2017.

It was also revealed that the percentage of property sales going to first-time buyers has seen little change, with approximately one in four properties being sold to those taking their first step onto the property ladder.

Commenting on these statistics, Chief Executive of the NAEA – Mark Hayward – said that vendors and buyers are “hoping to get everything tied up so they can enjoy their summer holidays without worrying about viewings.

“But those willing to be more flexible might do well to hold off until the market’s quieter in July and August.”

“Not everyone heads abroad over the summer, with lots of people opting for winter sun instead, so while the market is undoubtedly quieter, competition is a little less intense, which might better suit some buyers and sellers”.

What Are the DIY Jobs That We Can’t (Or Won’t) Do?

Owning a home means that getting involved with home maintenance from time to time cannot be avoided, but depending on your level of DIY confidence, there are a number of jobs that you’ll find are best left to a professional.

A recent survey looked into which DIY tasks we most commonly avoid or are unable to tackle on our own.

This survey was carried out by Emo Oil, who quizzed adults throughout the UK on just how handy they are around the house, and as it was discovered, only half (52%) of those surveyed would seek professional help.

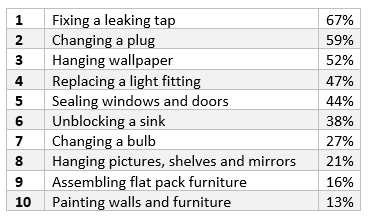

The most common issue when it comes to fixing up their home was found to be fixing a leaking tap, which just over two thirds (67%) of respondents did not know how to fix.

After which, the next most avoided DIY job is changing a plug, something that 59% of Brits find to be too much of a challenge, followed by hanging wallpaper (52%).

Electrics are clearly an area that most of us stay away from – when possible – as 47% of us can’t or won’t replace a light fitting. According to Emo Oil, even sealing windows and doors is a job for someone else, with 44% admitting that they can’t complete this task.

So why aren’t we getting our hands dirty when it comes to maintaining or upgrading our home? Well, the survey also found that 77% of us simply do not feel confident enough to finish the job properly, if at all. Whilst at the same time, 36% of survey participants stated that they have a professional on the other end of the phone, who they tend to fall back on.

The full list of avoided DIY tasks can be seen below:

Group Marketing Manager at Emo Oil – Susanne Waddell – believes that we may be overestimating some of these tasks, especially as there is plenty of information available these days that can help us along the way. She said, “It’s interesting to see how, despite having access to a wealth of information at our fingertips, a significant number of UK homeowners and tenants don’t feel confident in their abilities to carry out simple DIY tasks around the home.There are some DIY jobs that are best left to the professionals, but there are other simple tasks which individuals could save money on by doing these themselves. Once they have the know-how, they realise how much easier it makes life and they can get to work on the task at hand, rather than waiting for a professional to step in.You might also enjoy...

Buying a Second Home: What to Consider

Whether it’s a little country escape, a place by the sea or even somewhere abroad, who wouldn’t love a home away from home?Whilst this may be a lovely daydream, the reality of owning more than one property can be complicated, with several extra factors to consider before making your dream a reality. We’ve put together some facts you should consider before taking the leap into second home ownership.Why do I need this property?You will need to have a serious heart-to-heart with yourself and your other half about the purpose of buying your second property.It is important to bear in mind that you will need to go through the stressful process of buying a home, with the added stress of the property not being in your local area, as well as furnishing and decorating the property, and the end result is you own a property you will probably only visit a handful of times each year.There are other options available to you depending on what your needs are, for example, if you’re dreaming of a holiday home why not look into a timeshare? Or if you’re a professional looking for accommodation in the city, you could consider renting.Location, location, locationThe location of your property will affect every aspect of your ownership. Whilst it is lovely to have a home that’s 150 miles away from all of the day to day stress, that’s a 300-mile round trip every time you’re looking to visit.If you are considering a holiday home and would like to act as a landlord when you aren’t occupying the property, then you will need to consider how you will keep tabs on the property when you are so far away. Little details like finding trustworthy tradesman become more complicated when you don’t know the area.You should also consider whether you know the area you’re looking to buy in well enough before you finalise anything. For example, cheap property in the city might be in a student area. It’s worth doing some research before making the move.The cost of running your second homeYou will also need to consider the cost of running your second home. You will need home insurance, broadband, telephone, electricity, water and heating as well as paying the various taxes that come with owning property.Whilst you won’t be paying the same rates (because you won’t be there all the time) however, certain bills (like the internet) will stay at the same rate no matter the amount of usage you get from the service.You will also need to consider taking steps like keeping your heating on during the winter so that the pipes don’t freeze.MortgageSecond homes are not exempt from taxes like stamp duty and capital gains tax, which will add to the cost of purchasing your property. You will also have to decide whether to take a loan for your property or to remortgage your main home.For any help or advice when it comes to property, speak to us. Our team would be more than happy to help you with the right information to get you started and can help you find a home to suit your needs.

You might also enjoy…

Vendors and Buyers Return to the Market

What Are the DIY Jobs That We Can’t (Or Won’t) Do?

What is the Average Difference Between the Asking and Selling Price?

What is the Average Difference Between the Asking and Selling Price?

When selling your home, deciding on the right asking price is vital for generating a good amount of interest in your property. Obviously, you want to get the most out of your home, but it’s important that you don’t price yourself out of the market.But how does the average UK asking price compare to the average selling price? Well, new research has sought to find this out…According to a report from Emoov, there’s quite a large gap between these two figures, with the average UK asking price currently standing at &414,359, whilst the selling price stands at &226,906 – a surprising 45% difference.Although this is a shocking statistic at first glance, it does not mean that every homeowner looking to make a sale needs to chop their price by almost half to attract a buyer.Emoov’s report discovered that Scotland had the smallest gap between asking and selling price, showing a 16% difference as vendors were asking for an average of &186,371 and homes sold for &156,495.England was top of the table with the largest gap, as homes were being listed for &323,336 but selling for an average of &243,639, a considerable difference of 25%.In terms of individual regions, cities and towns, it was South Gloucestershire that saw the greatest difference, with homes selling for 43% less (&267,397) than the average asking price in the area (&470,117).Inverclyde followed closely behind, with a 41% gap, and East Ayrshire recording the 3rd largest gap of 31% and an average sold price of &93,053.Although most areas show similar statistics, there are a few locations that boast an increase on the asking price. East Riding of Yorkshire saw a 3% increase on their average &170,981 asking price, Nottingham was up by 2%, and the Orkney Islands and North Somerset both saw a 1% rise.If you’re looking to make a move and considering selling your home, why not speak to us? We can provide you with an accurate and up-to-date valuation, and our knowledge of the local area can help you price your home appropriately, ensuring that you achieve the highest price possible.

You might also enjoy...

Vendors and Buyers Return to the Market

What Are the DIY Jobs That We Can’t (Or Won’t) Do?

Buying a Second Home: What to Consider

<< News

|

|