|

Homeowners Are Regaining Confidence In The UK Property Market, Plus More

In this month's edition, following a period of uncertainty in the wake of the European Referendum, there are signs of renewed confidence in the property market and homeowners who don't remortgage at the right time are wasting millions of pounds each year.

Also this month, we reveal the top twenty must have home features and we reveal which options are available to first-time buyers.

Homeowners Are Regaining Confidence In The UK Property Market

While there has been plenty of uncertainty surrounding the UK economy, the property market has remained strong in the two years since Brexit.

Many homeowners and potential movers became hesitant when it came to making decisions on their home during this time, however, new data suggests that confidence in the market is on the rise.

A recent Housing Market Sentiment survey hoped to discover how confident each region in the UK is about their home and their expectations for the next six months.

The survey revealed that 84% of homeowners in Britain believe that property prices in their area will rise over the next six months. When the same survey was taken six months ago, this figure stood at 70%, which is quite the change in such a short space of time.

This is the largest increase in confidence since pre-Brexit, and on top of this, homeowners expect rises by an average of 6.9% in their area; another figure that has seen a jump, as it stood at 4.9% six months prior.

In terms of individual regions, the East Midlands was the most optimistic, with 93% of survey participants from this region believing that house prices will rise over six months. Sharing that same sentiment were homeowners in the East of England, with 90% feeling optimistic about house prices.

On the opposite end of the scale, the North East were the least upbeat regarding house prices, with only 63% feeling confident in price growth. However, this figure is an improvement, with a 22% boost in confidence since November 2017.

When looking at the rate at which survey participants expect prices to rise, the West Midlands had the highest expectations throughout the UK, predicting a 10.6% increase in property values by the end of the year. The East Midlands weren’t too far behind, forecasting a 9.2% increase.

If you would like an up to date price for you property, instantly book an appointment online now for one of our professional team to provide you with some free advice on your property without any obligation or commitment. www.pygott-crone.com/valuation.

Also this Month:

Homeowners Waste &53m by Not Remortgaging

Top 20 Must-Have Home Features

First-Time Buyers: What Are Your Options?

Homeowners Waste £53m by Not Remortgaging

It's very easy to organise your mortgage when buying a new home, get a great fixed rate deal and then completely forget about it for years as you make your monthly payments.

New data from Dynamo, part of the mortgage broker Countrywide, has revealed just how much money is wasted by homeowners sitting on their mortgage after the fixed term.

When a fixed term mortgage comes to an end, if the owner has not lined up a new deal they will be moved onto the standard variable rate (SVR) of the lender.

The interest on an SVR will normally be considerably higher than the current deals available and the results of the research have shown this to be true.

According to Dynamo, homeowners that fail to organise a new deal before their current deal expires end up paying the price by an average of &371.

Most people don’t get around to finding a new mortgage deal until 6 weeks after the end of their original deal, meaning they’re wasting an average of &62 a week and collectively, the UK is wasting &53.3M on their mortgage.

For some, these unnecessary payments could be three times the amount, as some SVR’s stand at six per cent.

Chief Executive at Dynamo – Seb McDermott – said; “The research shows that far too many people are not switching mortgage deals in time. This can prove costly - to the tune of nearly &62 a week for the six week period - which is more than the average family food shop.”

In addition to the this, it appears that some may need educating regarding their mortgage payments, as separate research from MoneySuperMarket revealed that over 16% of homeowner have no idea at all what will happen when their fixed term comes to an end.

Sally Francis-Miles of MoneySuperMarket stated; “The UK mortgage market is worth &1.3 trillion so if even a quarter of those with a mortgage can save a few hundred pounds each, that’s a drastic amount.

“There are many tools online to look at available deals, and re-mortgaging is far simpler than getting a mortgage when buying or selling, especially if you’re able to switch to a better deal with your existing provider.”

To find out how much you could save or to get a new mortgage quote visit our website to instantly search through thousands of different mortgages to find the best deal for you. www.mortgageadvicebureau.com/lincoln

Top 20 Must-Have Home Features

When hunting for a home it’s best to figure out your wants and your needs so that you easily weigh up your options after you’ve viewed a few properties.

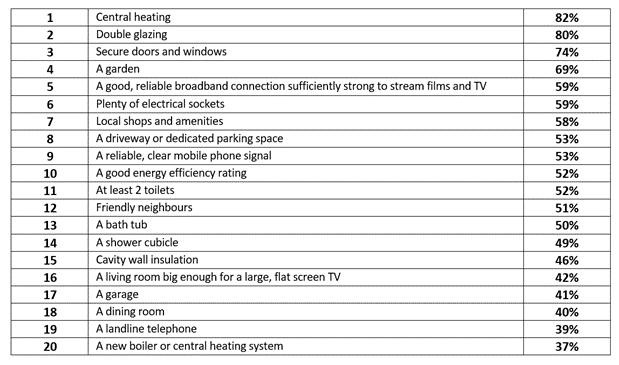

Whether it’s a strong internet connection or a bathtub, we all know which features we can’t live without, but what are the must-have features for buyers in the UK?

A new survey from Go Compare has quizzed over 2,000 Britons, in order to determine which features are vital to a prospective buyer.

Keeping warm during the colder months appears to be the main priority for homeowners, as central heating and double glazing take first and second place with 82% and 80% of respondents singling them out as must-have features.

Security is, of course, a huge selling point for any home and in regards to the recent survey, it was no different, as secure doors and windows took third place with 74% adding it to their ‘must have’ list.

With reports earlier this year finding that almost half of buyers wouldn’t even consider a home that didn’t come with a garden, it's no surprise that the fourth most popular must-have feature (69%) was a garden.

Support for all of the gadgets of a modern home is clearly vital, in fifth and sixth place was a good reliable broadband connection and plenty of electrical sockets.

What may be surprising or just a sign of the times was that a dining room was only considered a deal breaker by 40% respondents, taking 18th place in the top 20.

Although the majority of us carry a smartphone, landlines appear to still be in regular use, as 39% of survey participants stated they wouldn’t buy a house without one.

Spokesman for Go Compare – Ben Wilson – discusses the results of the survey, stating; “Buying a home is the biggest financial commitment most people will make. So, before viewing properties it is helpful to have an idea of the type of area and property you'd like to live in and think about your real must-have priorities.

“Connectivity and energy efficiency are two massive factors for anyone thinking about a move at the moment, while the number of electrical sockets is now more important than access to local amenities. Likewise, a broadband signal fast enough for streaming, and a reliable and a clear mobile phone signal are deemed home essentials today and sellers need to be wise to these new priorities.”

If you are looking to buy or sell and would like advice on property improvements visit www.pygott-crone.com or contact us for some free advice.

First-Time Buyers: What Are Your Options?

With the recent cut in stamp duty for first-time buyers and low-interest rates, many property experts are predicting considerable growth in the number of first-time buyers in 2018.

The housing market can be an inhospitable place for young first-time buyers. It requires a dedication to an end goal that borders on single-mindedness with many sacrifices along the way, but it is not impossible to buy a home.

To get you started on your climb up the property ladder, we’ve decided to take a look at some of your best options as a first-time buyer.

Where should you start?

Save. It’s a simple first step, but it’s the one that the majority of buyers struggle with the most. Putting a little away here and there simply won’t cut it, you need to be consistently squirrelling away money, sacrificing holidays and big money spends, in an attempt to scrape your deposit together.

Fortunately, there is help out there. Do some research and find a savings account with the best interest rate. The most popular savings account for first-time buyers at the moment is the Help to Buy Isa.

This account allows you to make monthly deposits of up to &200 until you either buy your first home or reach the &12,000 limit. Once you actually purchase a home, you can put the savings from your Help to Buy ISA towards the deposit, and after the sale is complete you will receive a 25% bonus from the government. For example, if you had &12,000 saved, you would receive a &3,000 bonus after completion.

What are your options?

If you already have some money saved up, but you're just short of the mark, it may be worth considering the following options.

Rent to Buy

Rent to Buy allows you to choose a home that you will one day buy, but in the meantime, you’ll only have to pay a reduced amount of rent (80%), meaning you can save the other 20% for a deposit. Once you enter this scheme, it lasts for five years. During that time, you can buy the property outright, or you can pay for a 25% or 75% share of the property.

0% mortgage

A 0% mortgage is similar to a 5% mortgage, in that a guarantor must put forward 10% of the deposit, whilst you put down nothing. The guarantor will receive the cash back, provided that you keep up with your mortgage repayments.

Bank of mum and dad

When all else fails, what better place to go than the good old reliable bank of mum and dad. Many of the options above require your parents to act as a guarantor anyway, so why not just go straight to the primary source?

Whilst it might seem daunting to begin saving for a property, there are many options that can help you take your first tentative steps onto the property ladder. Do some research and find out which options suit you best.

If you are looking to purchase your first home, visit www.pygott-crone.com and set up instant property alerts and be the first to hear about our new properties for sale.

<< News

|

|