|

Buyer Demand Outpaces The Number of Properties 12 to 1, Plus More

In this month's edition, there are twelve buyers for every one property and we share some money-saving advice for your home.

Also this month, UK homes gain £44 a month in value and we share five ways to make your property search easier.

Buyer Demand Outpaces The Number of Properties 12 to 1

Since the start of the new year, there has been a significant surge in new buyers coming to the market, and due to the lack of sellers, there has been a serious demand for property in the UK.

A new report from haart investigated the activity between buyers and sellers over the last 12 months to establish the difference between the two.

According to their analysis, total buyer registrations rose by 22.1% year-on-year, a huge rise in comparison to sellers coming to the market over the same period, as there was only an increase of 6.5%.

As a result of recent changes to stamp duty, it was reported earlier this year that first-time buyers are now rushing to the market, with this demographic growing by 16.8% from month-to-month alone.

Due to the considerable rise in new buyers entering the market, this now means that, on average, there are 12 buyers competing for each home available for sale in the UK.

Unsurprisingly, transactions have taken a 10% fall month-on-month, whilst the average number of viewings for buyers has increased, indicating that buyers have become more thorough in the search for their perfect home.

With a growing demand for homes, it is expected that house prices will also increase and there have already been reports that the average UK home has increased in value by 1.27% in the first quarter alone.

The shortage of available homes this spring has created a great opportunity for those considering putting their property on the market, with many property experts advising homeowners to take advantage before balance returns to the property market.

CEO of haart – Paul Smith – said “We are also continuing to experience a much more motivated and mobile cohort of first-time buyers, who are continuing to take advantage of the Stamp Duty exemption – keen to finally escape the rental trap, or to get out from under Mum and Dad's roof. Four months down the line we are still experiencing a 17% increase in numbers entering the market on the month. All the more reason to get your starter home on the market.

“More promising still, we also saw a 22% increase of landlords registering to buy across England and Wales, and 18% in London. Despite a barrage of restrictions and additional costs as a result of government policy, many are recognising the value that can still be found in buy-to-let property, especially in comparison to the overvalued and faltering stock market. Although conditions are much tougher, demand from tenants is growing and if you are willing to look slightly further afield there are still yields of around 7% to be gained.”

Money Saving Advice For Your Home

There are a few changes that you can make around the house that could save you hundreds of pounds a month! Some of them are as simple as clicking a button or turning a dial.

•

• Over half of households are expecting to make improvements involving double glazing, a third set to add or improve insulation, 13% planning solar panels and 7% introducing measures to be carbon neutral.

________________________________________

•

Switch your utility supplier

Your first port of call should be your utility bills. A recent study by Energyhelpline found that the average household can save over £600 a year by switching suppliers. You should consider changing the supplier of your television package, broadband and energy to a competitor who might offer you a better deal.

Consider your energy set-up and habits

Switching supplier is a good start, but your next job is to take a closer look at your energy habits. This can be as basic as turning your thermostat down by a few degrees or making use of the timer control on your boiler. Clothes horses can be utilised to dry your laundry, meaning you don’t need to have the heating on for longer than required.

If you want to make more of an impact on your energy bill, you could also consider your property’s energy efficiency. Just one in every thirteen properties sold across England and Wales over the last year achieved an energy rating of A or B, London the greenest region with one in eight. However, over 40% of the properties sold could reach an A or B with energy improvements.

To combat wasting energy, you could deploy draught excluders around the house to trap heat or hire a professional to examine the insulation in your walls and roof. 2.2 million households are anticipated to spend just over £16 billion on ‘green’ improvements to their homes this Spring according to new research by AA Financial Services.

Turn electrical appliances off when not in use

The Energy Saving Trust recently revealed that across the UK, households were spending between £50-86 a year on gadgets in a ‘non-active’ or standby state, equivalent to 9-16% of the average electricity bill.

Set your washing machine to a lower temperature

Washing at 15 or 30 degrees rather than 40 degrees can save you a third of the cost to run the cycle. Think about how much that could be saving you on the day you decide to tackle the overflowing laundry basket!

Switch to a cheaper mortgage deal

Mortgage repayments are often the biggest monthly expense a household will have, so it could be worth checking if switching to a new deal can help you save.

For example, if you have a £180,000 20-year mortgage, a deal that charges 4% would cost your household £1,091 a month. Remortgaging to a 2% rate could save you £180 a month (£2,160 a year).

UK Homes Gain £44 In Value Daily

Positive signs for the UK property market as the first quarter of 2018 recorded an average growth of 1.27% in property prices.

Statistics have revealed that homes in Britain gained £44 in value for every day between January and March of 2018, an average of £3,917 added to the price tag of a home, resulting in a collective growth of £114 billion.

This takes the overall value of UK property to a staggering £8.3 trillion.

These new figures are quite the contrast to reports from the same period last year, where the collective value of UK homes fell by £29 billion.

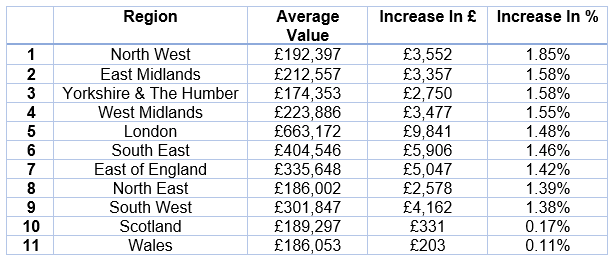

The region to see the largest growth during the first quarter of 2018 was the North West, recording an increase of 1.85% (£3,552) taking the average value of a home in the region to £192,397.

Following closely behind were the regions of the East Midlands and Yorkshire & The Humber, both seeing a rise in value of 1.58% taking their average house prices to £212,557 and £174,353, respectively.

At the other end of the table are Wales and Scotland, where property prices increased the least. Welsh homes grew in value by 0.11%, only a £203 increase with average values now standing at £186,053. Scotland fared slightly better showing a 0.17% increase of £331 to £189,297.

While the national average for house price growth stood at 1.27%, there were some areas of the UK that saw more than double the average in increases.

Sidcup in Kent, Heathfield in East Sussex and Wallingford in Oxfordshire all recorded growth of 2.84% or higher and added more than £11,000 to their property’s price tag.

5 Ways to Make Your Property Search Easier

We all know that searching for a home can be quite a long process. Studies have shown that it can take up to 3-4 months, viewing a total of 8 houses on average before most buyers find the house that’s right for them. The only way to make it easier for yourself is by doing a little research and preparation before you dive in. We’ve put together 5 simple steps to make your hunt for a home that little bit easier.

Figure out your finances

Before the search begins you absolutely must figure out exactly how much money you have to play with, taking into consideration the full cost of buying a home. It’s not just the cost of the property, but also the cost of surveys, stamp duty and more.

There is no such thing as ‘too early’ when it comes to looking at mortgages and speaking with financial advisors. While setting up meetings and discussing your finances with a mortgage advisor can be time-consuming in itself, once you’ve determined your maximum spend it allows you to greatly refine your search and also puts you in a stronger position further down the line when it comes to negotiating.

Separate your wants from your needs

You probably already have an idea in your head of what your dream home looks like, what features it has and the type of area its located in. Unfortunately, for most buyers finding your dream home takes a lot of luck or a lot of money so you need to decide early on which features are the ‘must haves’.

Every buyer’s criteria is different, whether it is the size of the kitchen, being close to a good school or the number of bedrooms. A successful home search does require a little bit of compromise so separating your wants from your needs allows you to begin your search with a lot more focus, saving you time in the long run as you won’t need to head out all the time for endless viewings.

Take advantage of all the information available to you

In the past, a lot of property information such as how much it previously sold for, floor plans and general statistics for the area were not as easily accessible as they are today. There are plenty of websites that allow you to do that extra bit of research, allowing you to make more educated decisions throughout the process.

Find out what the average price is for homes in your favourite area, take a look if a home you have your eye on has a surprisingly high flood risk. With buying a home being the biggest purchase you’re ever going to make, the extra research you put in could not only protect you from hidden disasters in the long term, but also means you’re able to be a little more brutal with your shortlist as you take advantage of the wealth of information available online.

Get in touch with us!

While the internet does hold plenty of useful information on the property market, if you’re looking for in-depth knowledge of the local area, then your local estate agent is always your best bet. By speaking to your estate agent you can get some more information on the current state of the local market, which is incredibly valuable information if you’re moving to a new area.

If your essential property criteria include the commute to work or the good local schools, a good agent will be able to bring even more focus to your search and help you avoid any homes that are unsuitable to your needs.

Be thorough, be brutal

Once the viewings begin it’s important that you gather as much information as possible during your time in the property. Take notes, take photos and ask plenty of questions. After a few viewings you may find that all the properties begin to blur together in your memory, so the more information you collect the first time around, the more time you save from not having to go back, again and again, to feel the place out.

At this point you’ve already made a list of the things you can’t live without, so to speed up the process, you should also create a list of things you can’t live with. If your shortlist only contains 3 or 4 properties, then it may be best to take a slightly more lenient approach when discovering a room will need completely redecorating. However, if your shortlist of homes is in the double digits, you’d be wise to be thorough and spot any deal breakers early as a long list of homes will require you to be brutal, unless you want to spend months going from viewing to viewing.

Overall the key to a successful property search is to make sure you’ve done your homework and have as much information as possible to make an educated decision when you see ‘that’ property and your heart takes over. Being able to determine exactly what you want early can be a massive help and by combining the online information with the knowledge of your local expert, you can make finding a home a much smoother process.

<< News

|

|